Full article: Estimating the revenue losses of international corporate tax avoidance: the case of the Czech Republic

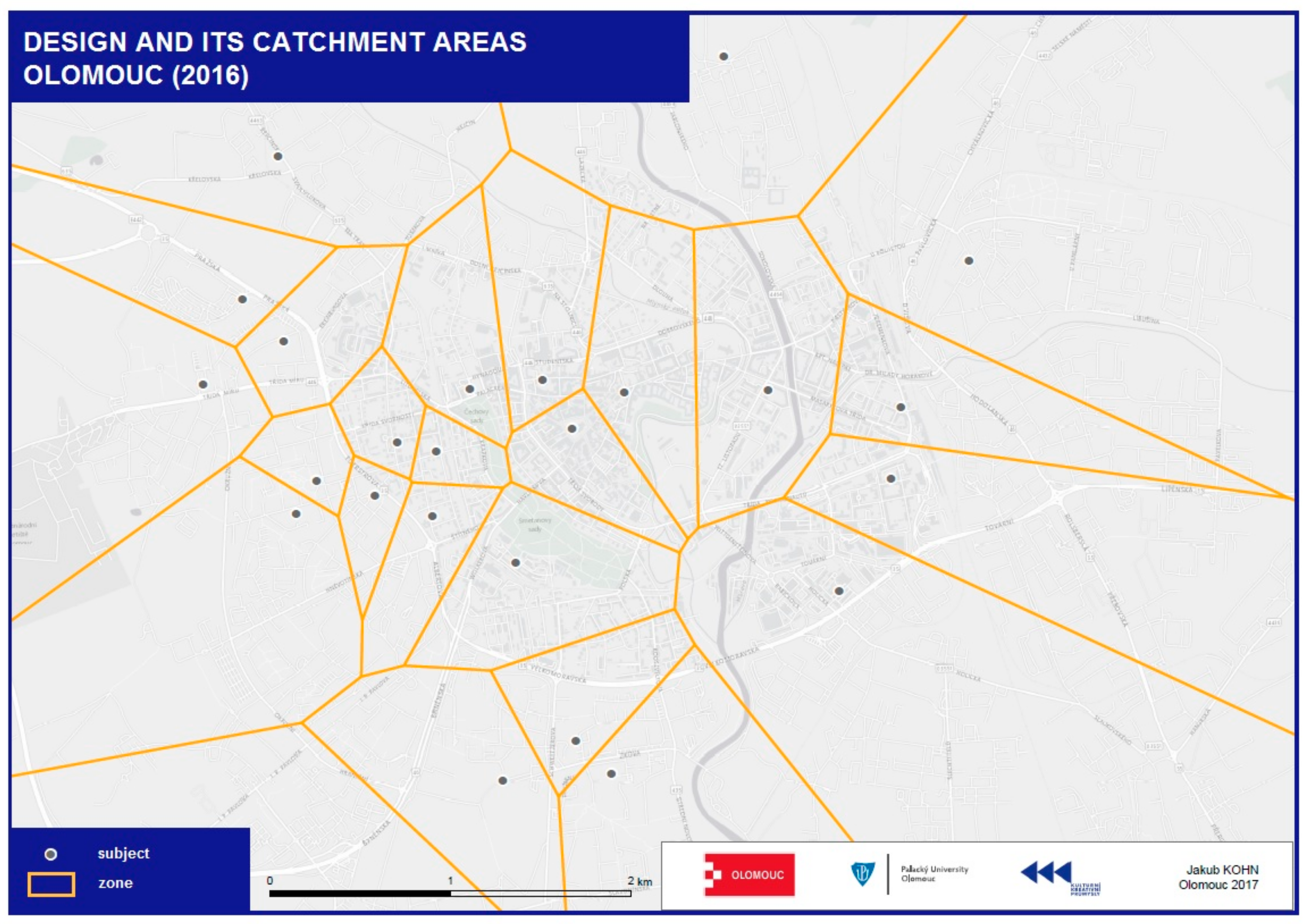

IJGI | Free Full-Text | Mapping Creative Industries: A Case Study on Supporting Geographical Information Systems in the Olomouc Region, Czech Republic | HTML

European studies - The Review of European Law, Economics and Politics, volume 3, 2016 by Czech Association for European Studies - issuu