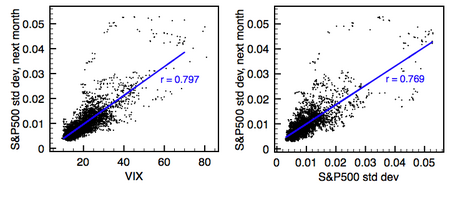

Why the volatility is log-normal and how to apply the log-normal stochastic volatility model in practice | Artur Sepp Blog on Quantitative Investment Strategies

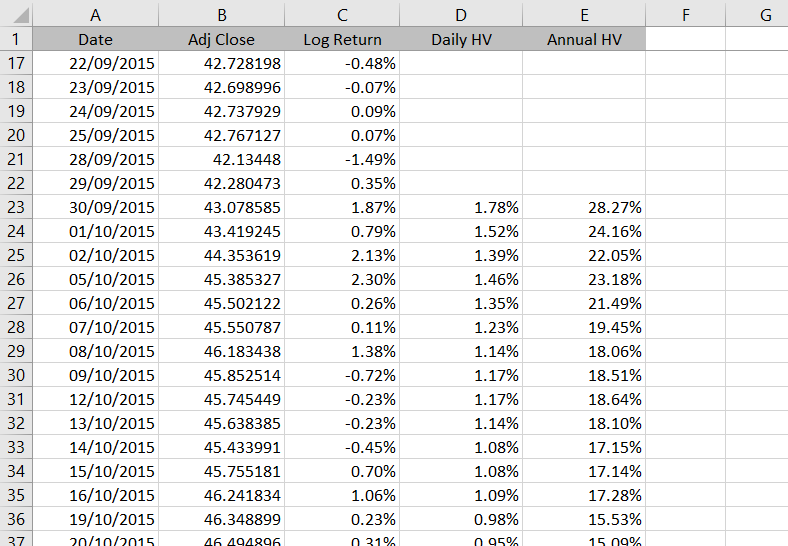

log (ln) returns in volatility calculation and annualization of metrics · Issue #29 · quantopian/zipline · GitHub